utah778

Dear Baron Real Estate Income Fund Shareholder:

Performance

On September 28, 2023, we hosted a client educational webinar, titled “Demystifying Real Estate: An Optimistic Perspective on the Prospects for Real Estate.” A replay of the webinar can be accessed on our Baron website homepage at baronfunds.com in the “Insights & Reports” section. A sampling of the key messages from the webinar can be found below after the “Performance” section of this letter.

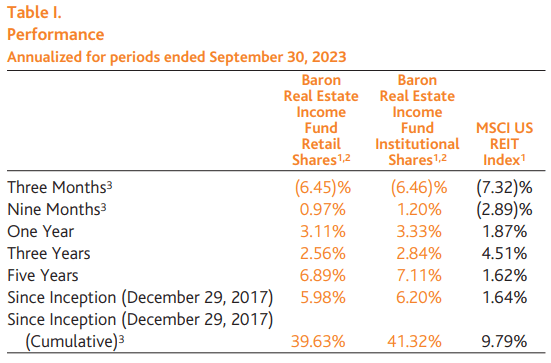

Following a strong first six months of 2023, the stock market, most REITs and non-REIT real estate companies, and the Baron Real Estate Income Fund® (MUTF:BRIFX, MUTF:BRIIX, MUTF:BRIUX) (the Fund) declined in the third quarter. The Fund declined 6.46% (Institutional Shares), modestly outperforming the MSCI US REIT Index (the REIT Index), which declined 7.32%.

In the first nine months of 2023, the Fund has increased 1.20%, outperforming the REIT Index, which declined 2.89%.

In the third quarter, several factors weighed on stocks, including higher interest and mortgage rates, higher oil prices, the prospect that monetary tightening may persist for several quarters as inflation remains above central bank targets, concerns about China’s economic growth prospects, a few company earnings disappointments, and the possibility of additional economic growth headwinds including the lag effects of the Federal Reserve’s tightening, student loan payments, and union strikes.

Though we are mindful of key risks to the equity and real estate market outlook, we remain optimistic about the prospects for the Fund. We believe the Fund is populated with attractively valued best-in-class REITs and non-REIT real estate companies with strong long-term growth prospects. We believe the Fund’s two- to three-year return prospects are compelling.

Since inception on December 29, 2017 through September 30, 2023, the Baron Real Estate Income Fund is the #2 ranked real estate fund according to Morningstar – only trailing the three share classes of the Baron Real Estate Fund. The Fund’s cumulative return of 41.32% far exceeds the REIT Index, which has increased 9.79%.

|

As of 9/30/2023, the Morningstar Real Estate Category consisted of 253, 230, 213, and 225 share classes for the 1-, 3-, 5-year, and since inception (12/29/2017) periods. Morningstar ranked Baron Real Estate Income Fund Institutional Share Class in the 16th, 64th, 3rd, and 2nd percentiles for the 1-, 3-, 5-year, and since inception periods, respectively. On an absolute basis, Morningstar ranked Baron Real Estate Income Fund Institutional Share Class as the 40th, 151st, 5th, and 4th best performing share class in its Category, for the 1-, 3-, 5-year, and since inception periods, respectively. Morningstar calculates the Morningstar Real Estate Category Average performance and rankings using its Fractional Weighting methodology. Morningstar rankings are based on total returns and do not include sales charges. Total returns do account for management, administrative, and 12b-1 fees and other costs automatically deducted from fund assets. © 2023 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely; and (4) does not constitute advice of any kind, whether investment, tax, legal or otherwise. User is solely responsible for ensuring that any use of this information complies with all laws, regulations and restrictions applicable to it. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. MORNINGSTAR IS NOT RESPONSIBLE FOR ANY DELETION, DAMAGE, LOSS OR FAILURE TO STORE ANY PRODUCT OUTPUT, COMPANY CONTENT OR OTHER CONTENT. |

As of September 30, 2023, the Fund has maintained its top 3% ranking among all real estate funds for its 5-year performance period.

We will address the following topics in this letter:

- Demystifying real estate: an optimistic perspective on the prospects for real estate

- Portfolio composition and key investment themes

- Top contributors and detractors to performance

- Recent activity

- Concluding thoughts on the prospects for real estate and the Fund

|

Performance listed in the above table is net of annual operating expenses. The gross annual expense ratio for the Retail Shares and Institutional Shares as of December 31, 2022 was 1.32% and 0.96%, respectively, but the net annual expense ratio was 1.05% and 0.80% (net of the Adviser’s fee waivers), respectively. The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month end, visit baronfunds.com or call 1-800-99-BARON. 1 The MSCI US REIT Index Net (USD) is a free float-adjusted market capitalization index that measures the performance of all equity REITs in the US equity market, except for specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The index and the Fund include reinvestment of dividends, net of withholding taxes, which positively impact the performance results. The index is unmanaged. Index performance is not Fund performance; one cannot invest directly into an index. 2 The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. 3 Not annualized. |

Demystifying Real Estate: An Optimistic Perspective on the Prospects for Real Estate

The highly unusual and challenging last few years (e.g., COVID-19, a sharp and rapid rise in interest and mortgage rates, credit market stress, and multidecade high inflation) have left many anxious and concerned about the prospects for real estate. Accordingly, last month, we thought it would be timely to host a client educational real estate webinar. The goal of our webinar was to demystify real estate – make it clearer, easier to understand, separate the facts from fiction – and provide our more optimistic perspective on the prospects for real estate. A sampling of our key messages is as follows:

Perception vs. Reality: We believe there are several perceptions about real estate that do not reflect reality. A few examples are listed below.

Perception: A commercial real estate crisis is on the horizon.

- Reality: Prospects for most of commercial real estate are encouraging.

Perception: 6% to 7% mortgage rates will cripple the new home sales market.

- Reality: New home sales are strong.

Perception: The American Dream to own a home is over.

- Reality: Millennials are buying homes.

Perception: Office real estate is “dead.”

- Reality: Elements of office real estate are performing well – globally and by type.

Manufactured Housing

- Secular tailwinds: Budget-conscious home buyers and high development barriers

Data Centers

- Secular tailwinds: Rising data consumption, cloud computing, IT outsourcing, artificial intelligence (AI)

Wireless Towers

- Secular tailwinds: Robust mobile data growth, 4G and 5G adoption

Senior Housing

- Secular tailwinds: Aging baby boomers and 80-plus population (“silver tsunami”)

Life Science

- Secular tailwinds: Pharmaceutical R&D and drug development

Self-Storage

- Secular tailwinds: Work from home

Hotels

- Secular tailwinds: Travel increasing as a percentage of wallet share

The Case for Public Real Estate & Key Investment Themes: We believe there is a strong long-term case to allocate capital to public real estate in an actively managed strategy.

Long-Term Case

- Inflation protection

- Diversification and low correlation to equities/bonds

- Strong historical long-term returns with ongoing potential

Near- to Medium-Term Case

- Much of public real estate has lagged

- Several public real estate companies are cheap

- May be near the end of the Fed tightening period – historically bullish for real estate

- We see generally attractive demand vs. supply prospects

- Balance sheets are in solid shape

- Wall of private capital is targeting public real estate

Benefits of Active Management

- Managers can focus on what they believe to be real estate winners and avoid the losers

- Managers can exploit mispricings

- Managers can embrace a benchmark-agnostic approach

Portfolio Composition and Key Investment Themes

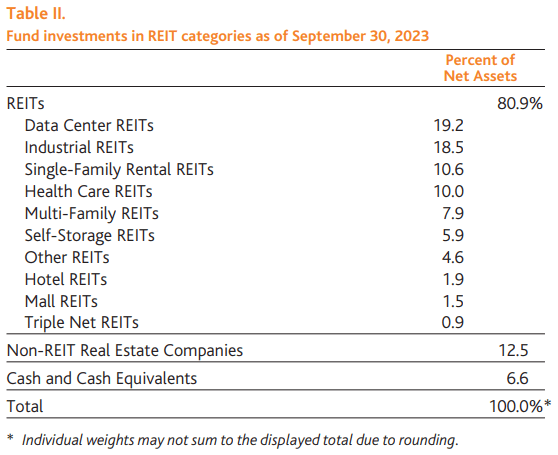

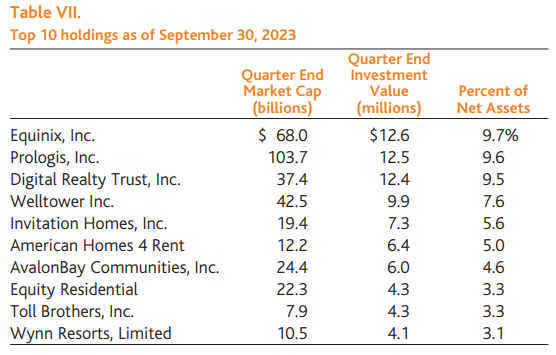

As of September 30, 2023, the Fund’s net assets were invested as follows: REITs (80.9%), non-REIT real estate companies (12.5%), and cash (6.6%). We currently have investments in 10 REIT categories. Our exposure to REIT and non-REIT real estate categories is based on our research and assessment of opportunities in each category on a bottom-up basis (See Table II below).

REITs

Business fundamentals and prospects for many REITs remain solid although, in most cases, growth is slowing due to debt refinancing headwinds, a moderation in organic growth (occupancy, rent, and/or expense pressures), and reduced investment activity (acquisitions and development). Most REITs enjoy occupancy levels of more than 90% with modest new competitive supply forecasted in the next few years due to elevated construction costs and contracting credit availability for new construction. Balance sheets are in good shape. Several REITs have inflation-protection characteristics. Many REITs have contracted cash flows that provide a high degree of visibility into near-term earnings growth and dividends. Dividend yields are well covered by cash flows and are growing.

Following the 25% decline in the REIT Index in 2022 and modest declines in the first nine months of 2023, REIT valuations have become attractive on an absolute basis relative to history and relative to private market valuations, but not relative to fixed income alternatives. If economic growth contracts and evolves into no worse than a mild recession and the path of interest rates peaks at levels not much higher than current rates, we believe the shares of certain REITs may begin to perform relatively well. Should long-term interest rates begin to decline and credit spreads compress, REIT return prospects may also benefit from an improvement in valuations as valuation multiples expand (e.g., capitalization rates compress).

We continue to prioritize secular growth REITs and short-lease duration REITs with pricing power:

- Secular growth REITs: Our long-term focus is on REITs that benefit from secular tailwinds where cash-flow growth tends to be durable and less sensitive to a slowdown in the economy. Examples include our investments in data centers, industrial logistics, and life science REITs. As of September 30, 2023, secular growth REITs represented 39.7% of the Fund’s net assets.

- Short-lease duration REITs with pricing power: We have continued to emphasize REITS that are able to raise rents and prices on a regular basis to combat inflation’s impact on their businesses. Examples include the Fund’s investments in single-family rental, multi-family, and self-storage REITs. As of September 30, 2023, short-lease duration real estate companies represented 24.4% of the Fund’s net assets.

Secular growth REITs (39.7% of the Fund’s net assets)

Data Center REITs (19.2%): In the third quarter, we increased the Fund’s exposure to data center REITs from 15.1% to 19.2%. We believe the multiyear prospects for real estate data centers are compelling. Data center landlords such as Equinix, Inc. (EQIX) and Digital Realty Trust, Inc. (DLR) are benefiting from record low vacancy, demand outpacing supply, and rising rental rates. Regarding the demand outlook, several secular demand vectors are contributing to robust demand for data center space globally. They include the outsourcing of information technology, increased cloud computing adoption, the ongoing growth in mobile data and internet traffic, and AI as a new wave of data center demand.

Industrial REITs (18.5%): Though we expect rent growth to moderate from its frenzied pace of the last few years, we remain optimistic about the long-term prospects for industrial REITs. With industrial vacancies at less than 4%, new supply expected to moderate in 2024, rents on in-place leases more than 50% below market, and multi-faceted demand drivers including the ongoing growth in e-commerce and companies seeking to improve inventory supply-chain resiliency by carrying more inventory (shift from just in time to just in case inventory), we believe our investments in industrial warehouse REITs Prologis, Inc. (PLD), Rexford Industrial Realty, Inc. (REXR), EastGroup Properties, Inc. (EGP), Terreno Realty Corporation (TRNO), and First Industrial Realty Trust, Inc. (FR) have compelling multi-year cash-flow growth runways.

Life Science REITs (2.1%): Alexandria Real Estate Equities, Inc. (ARE) is the life science industry leader and sole publicly traded life science pure-play REIT. At its current discounted valuation, we believe concerns about competitive supply and distress for some of the company’s biotechnology and health care tenants are overblown and sufficiently discounted in the company’s valuation. We believe the management team has assembled a desirable real estate portfolio, enjoys a leading market share position in its geographic markets, and has solid expectations for long-term demand-driven growth.

Short-lease duration REITs (24.4% of the Fund’s net assets)

Single-Family Rental REITs (10.6%): Following strong second quarter results, we modestly increased our investments in single-family rental REITs Invitation Homes, Inc. (INVH) and American Homes 4 Rent (AMH). Demand conditions for rental homes are attractive due to the sharp decline in home affordability; the propensity to rent in order to avoid mortgage down payments, avoid higher monthly mortgage costs, and maintain flexibility; and the stronger demand for home rentals in suburbs rather than apartment rentals in cities. Rising construction costs are limiting the supply of single-family rental homes in the U.S. housing market. This limited inventory combined with strong demand is leading to robust rent growth.

Both Invitation Homes and American Homes 4 Rent have an opportunity to partially offset the impact of inflation given that their in-place annual leases are significantly below market rents. Valuations are compelling at mid-5% capitalization rates, and we believe the shares are currently valued at a discount to our assessment of net asset value.

We remain mindful that expense headwinds and slower top-line growth could weigh on growth later in 2023 and 2024. We will continue to closely monitor business developments and will adjust our exposures accordingly.

Multi-Family REITs (7.9%): In the third quarter, we maintained our exposure to apartment REITs Equity Residential (EQR) and AvalonBay Communities, Inc. (AVB) at 7.9% of the Fund’s net assets. We believe public valuations remain discounted relative to the private market. Tenant demand remains healthy and rent growth has modestly improved since the first quarter of 2023. Rental apartments continue to benefit from the current homeownership affordability challenges. Multi-family REITs provide partial inflation protection to offset rising costs due to leases that can be reset at higher rents, in some cases, annually. We continue to closely monitor new supply deliveries and job losses in key geographic markets.

Self-Storage REITs (5.9%): In the third quarter, we reduced our exposure to self-storage REITs – Public Storage (PSA), Extra Space Storage Inc. (EXR), and CubeSmart (CUBE) – because we expect growth may continue to moderate in 2023.

Long term, there is a lot to like about self-storage businesses. Monthly leases provide an opportunity for landlords to increase rents and combat inflation. Self-storage facilities do not tend to require significant ongoing capital expenditures. Elevated construction costs are constraining new construction. Should economic growth continue to decelerate and perhaps lead to a recession, self-storage business fundamentals have historically held up well during economic downturns. We also believe there is a wall of capital from private equity companies that are interested in acquiring self-storage real estate should valuations in the public market become attractive relative to other opportunities.

Other REIT and non-REIT real estate investments (29.3% of the Fund’s net assets)

Health Care REITs (10.0%): We remain optimistic about our health care REIT investments in Welltower Inc. (WELL) and Ventas, Inc. (VTR) Health care real estate fundamentals are improving (rent increases and occupancy gains) against a backdrop of muted supply growth in the next two to three years due to increasing financing and construction costs and supply-chain challenges. The long-term demand outlook is favorable, driven in part by an aging population, which is expected to accelerate in the years ahead. Despite our optimism for long-term prospects for health care real estate, we are closely monitoring near-term expense headwinds combined with a slower-than-expected recovery in leasing and occupancy.

Other REITs (5.9%): We are optimistic about our REIT investments in Tanger Factory Outlet Centers, Inc. (SKT), Americold Realty Trust, Inc. (COLD), and the recent addition of DiamondRock Hospitality Company (DRH). Tanger owns and operates the second largest outlet center portfolio in the U.S. Tanger is the only mall REIT that focuses exclusively on outlets and, as a result, there is less risk from department store closures. We believe the shares are attractively valued and offer solid prospects for growth. Americold is the second largest owner-operator of cold storage facilities in the U.S. and globally. We believe the shares of Americold should benefit from steady growth in food consumption, limited new supply, and improvements in its operations, which should support solid growth. We discuss hotel REIT DiamondRock in greater detail below in the “Top net purchases” section.

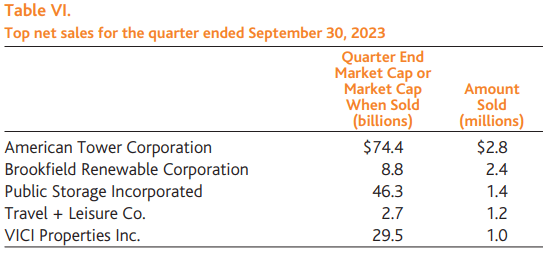

Triple Net REITs (0.9%): We have slightly decreased our already modest exposure to the triple net gaming REIT VICI Properties Inc. (VICI), an owner of quality gaming, hospitality, and entertainment properties. The company pays a 6% dividend that is well covered, has a strong track record of making accretive acquisitions, and has additional opportunities for growth in the years ahead.

Non-REIT Real Estate Companies (12.5%): We emphasize REITs but have the flexibility to invest in non-REIT real estate companies. We tend to limit these to no more than 20% to 25% of the Fund’s net assets. At times, some of our non-REIT holdings may present superior growth, dividend, valuation, and share price appreciation potential than many REITs.

We are bullish about the prospects for the Fund’s non-REIT real estate investments, which include: Toll Brothers, Inc. (TOL), Wynn Resorts, Limited (WYNN), Brookfield Corporation (BN), Brookfield Asset Management Ltd. (BAM), Lowe’s Companies, Inc. (LOW), Travel + Leisure Co. (TNL), and Brookfield Infrastructure Corporation (BIPC).

Top Contributors and Detractors

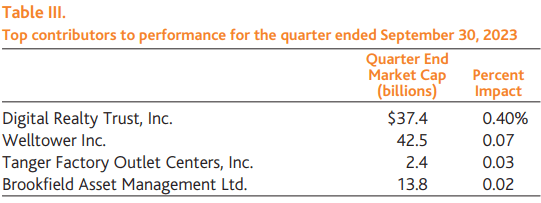

Following strong quarterly business results, the shares of Digital Realty Trust, Inc., a global data center operator with 290 data centers, continued to perform well in the third quarter. As noted in the Fund’s second quarter shareholder letter, we believe the multi-year prospects for real estate data centers are compelling – perhaps as strong as they have ever been. For our more complete thoughts on Digital Realty and the Fund’s other data center REIT investment in Equinix, Inc., please see “Top net purchases” later in this letter.

Welltower Inc., an owner and operator of senior housing and medical office buildings, was a contributor to performance during the quarter due to strong cash-flow growth in its senior housing portfolio driven by healthy rent growth and occupancy gains, robust demand from new residents, improving labor expenses, and superior capital deployment by management. Welltower owns and operates senior housing and medical office buildings in the U.S. and internationally. We believe the company continues to be well-positioned to benefit from cyclical and secular growth over the coming years and has a credible path to double its senior housing operating cash flow organically over the next four to five years. In addition, we believe the current constrained financing environment will create attractive external growth opportunities for the company to acquire quality assets at attractive prices.

The shares of Tanger Factory Outlet Centers, Inc., a real estate owner of the second-largest outlet center portfolio in the U.S., increased modestly following strong quarterly results. We met with CEO Stephen Yalof and CFO Michael Billerman earlier this year and came away impressed. The management team continues to look for opportunities to manage the business more profitably, prioritize Tanger’s digital transformation, and expand outlet center offerings. Tanger, unlike mall REITs, focuses solely on retail outlets so it is immune from department store tenant risk. We believe the shares are attractively valued and are optimistic about the company’s long-term prospects.

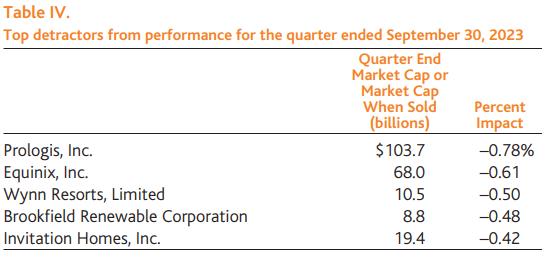

The shares of Prologis, Inc., the world’s largest industrial REIT, declined in the third quarter of 2023 along with most REITs. We are big fans of CEO Hamid Moghadam and Prologis’ management team, and we remain optimistic about the company’s long-term growth outlook.

Prologis owns a high-quality real estate portfolio that is concentrated in major global trade markets and large population centers across the Americas, Europe, and Asia. Prologis has an unmatched global platform, strong competitive advantages (scale, data, and technology), and attractive embedded growth prospects. The company is the only industrial REIT with an A credit rating.

We continue to believe the appreciation potential for Prologis shares remains compelling given that the company’s rents on its in-place leases are more than 65% below current market rents, thus providing a strong runway for growth in the next three to five years.

The shares of Equinix, Inc., the premier global operator of network-dense, carrier-neutral colocation data centers with operations across 32 countries, declined 7.1% in the third quarter following a 20.4% gain in the first six months of 2023. In the last few months, we have spent time with CEO Charles Meyers and CFO Keith Taylor and are encouraged about the company’s long-term prospects. Ultimately, we believe the underlying demand vectors, strong pricing power, favorable supply backdrop, and interconnection focus will support approximately 10% cash-flow-per-share growth for the next several years with upside from further scaling of digital services, incremental AI demand, and select M&A opportunities. We remain optimistic about the prospects for Equinix shares over the next several years.

The shares of Wynn Resorts, Limited, an owner and operator of hotels and casino resorts, declined 14.5% during the period held in the third quarter.

We remain optimistic about the multi-year prospects for the company. We believe the re-emergence of business activity in Macau will drive additional shareholder value. If cash flow returns to the level achieved in 2019 prior to COVID-19, we believe Wynn’s shares will increase to $150 per share, or more than 60% higher than where they have recently traded.

We believe additional drivers for future value creation beyond a re-emergence in Macau business activity include: (i) our expectation for long-term growth opportunities in the company’s U.S.-centric markets of Las Vegas and Boston, including an expansion of Wynn’s Encore Boston Harbor resort; (ii) Wynn’s plans to develop an integrated resort in the United Arab Emirates with 1,500 hotel rooms and a casino that is similar in size to that of Encore Boston Harbor; (iii) opportunities to improve cash-flow margins by rightsizing labor and achieving lower staff costs in Macau; (iv) the possibility that Wynn is granted a New York casino license in 2023; and (v) an expansion in the company’s valuation multiple to levels achieved prior to the pandemic.

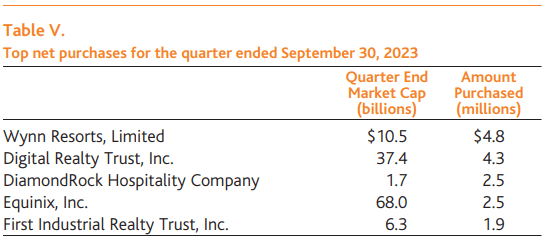

Recent Activity

In the third quarter, we re-acquired shares of Wynn Resorts, Limited, which we discussed in detail above.

We believe the multi-year prospects for real estate data centers are compelling – perhaps as strong as they have ever been. Accordingly, we recently increased our exposure to data center REITs by acquiring additional shares in Digital Realty Trust, Inc. and Equinix, Inc.

Data center landlords such as Equinix and Digital Realty are benefiting from record low vacancy, demand outpacing supply, more constrained power availability, and rising rental rates. Several secular demand vectors, which are currently broadening, are contributing to robust fundamentals for data center space globally. They include the outsourcing of information technology infrastructure, increased cloud computing adoption, the ongoing growth in mobile data and internet traffic, and AI as a new wave of data center demand. Put simply, each year data continues to grow exponentially, and all of this data needs to be processed, transmitted, and stored – supporting increased demand for data center space. In addition, while it is still early innings, we believe AI could not only provide a source of incremental demand but also further accelerate existing secular trends by driving increased prioritization and additional investment in digital transformation among enterprises.

We recently spent time with the management teams at both Equinix and Digital Realty and are optimistic about their prospects. We believe Equinix, the premier global operator of network-dense, carrier-neutral colocation data centers, is well-positioned to grow its cash flow per share by more than 10% annually for the next few years.

Digital Realty is a global data center operator with 290 data centers across North America, EMEA, APAC, and LATAM. Over the last few years, the company has been undergoing a business transformation, which accelerated after its acquisition of Interxion in March 2020, a pure-play European network-dense data center operator. The company has been shedding non-core slower growth assets, investing and expanding in Europe, growing its retail colocation business, improving its balance sheet, and adding operational expertise by supplementing new management leadership. We have spent a significant amount of time with CEO Andy Power over the years and believe the investments the company has made are on the cusp of bearing fruit and will pay dividends for years to come. In addition, we believe the fundamentals in its core business are at an inflection point with robust demand/bookings, pricing power, hyperscale cloud players outsourcing a higher percentage of their digital infrastructure needs, and limited competitive capacity. We believe these factors will lead to growth in the core business in 2023 and are optimistic about the long-term prospects for the company.

We initiated a position in DiamondRock Hospitality Company during the quarter. DiamondRock owns high-quality hotel assets skewed towards resort and leisure. While macroeconomic concerns have limited near-term share price performance, we continue to believe that the value of the irreplaceable leisure-focused portfolio the company has curated over the past 20 years will ultimately be realized either in the public or private markets. There is a significant amount of undeployed private equity capital on the sidelines geared toward the exact types of assets that DiamondRock owns. Shares remained attractively valued both on a relative and absolute basis with the company being conservatively capitalized relative to its peers and with no near-term debt maturities.

Early in 2023, we reduced the majority of our position in American Tower Corporation (AMT), a global operator of over 200,000 wireless towers, and exited our small position in the third quarter. While we are positive on the long-term secular trends underpinning American Tower’s business, we concluded in late 2022 and early 2023 that growth expectations were too high given forthcoming headwinds from significantly higher financing costs (20%-plus exposure to floating rate debt), upcoming debt maturities, continued payment shortfalls from a key tenant in India, foreign exchange headwinds, and a possible reduction in mobile carrier capital expenditures.

As shares have become more attractively valued, growth headwinds are better understood, and with a potential monetization event of its India business, we may look to re-acquire shares.

Shares of Brookfield Renewable Corporation (BEPC) underperformed significantly in the quarter. The approximate 100 basis point increase in risk-free rates during the quarter made yield stocks less attractive to investors. In addition, select industry headwinds such as supply-chain issues, development delays, and lower return targets weighed on the shares as well. While Brookfield Renewable has not, to date, been impaired by ongoing industry issues, we exited our position due to ongoing industry concerns and reallocated capital to higher-conviction ideas. We may revisit Brookfield Renewable as some of the clouds clear and return prospects become more evident.

We recently trimmed our investment in Public Storage, a REIT that is the world’s largest owner, operator, and developer of self-storage facilities, due to expectations that rent and overall cash-flow growth may continue to moderate.

Public Storage’s nearly 2,500 self-storage facilities across the U.S. serve more than one million customers. The company has achieved the #1 market position in 14 of its top 15 markets. Despite our near-term caution, we are optimistic about the company’s long-term prospects due to our expectations for strong occupancy, limited new supply, the resumption of solid long-term organic cash-flow growth, and the potential for M&A due to its well-capitalized and low-leveraged balance sheet and its ability to increase rents monthly to offset inflation headwinds. We believe Public Storage’s shares are currently valued at a discount to private market self-storage values.

Concluding Thoughts on the Prospects for Real Estate and the Fund

We remain mindful that the current economic and investment climate is challenging. Though we do not have a crystal ball regarding the macroeconomic and geopolitical outlook, we remain optimistic about the long-term prospects for the Fund.

We believe we have assembled a portfolio of best-in-class competitively advantaged REITs and non-REIT real estate companies with compelling long-term growth and share price appreciation potential. We have structured the Fund to capitalize on compelling investment themes. Valuations and return prospects are attractive.

We believe the Fund’s approach to investing in REITs and non-REIT real estate companies will shine even brighter in the years ahead.

For these reasons, we remain positive on the outlook for Baron Real Estate Income Fund.

I and the rest of our Baron real estate team – David Kirshenbaum, George Taras, and David Baron – remain energized, focused, and busy meeting with and speaking to real estate management teams. We continue our comprehensive research, speaking to a broad swath of real estate companies – both owned and not owned – in many cases a few times each quarter to make sure our research remains current and informed. We believe our corporate relationships and access to management are critical elements that contribute to competitive advantages for our real estate team versus many of our peers.

I, and our team, remain fully committed to doing our best to deliver outstanding long-term results, and I proudly continue as a major shareholder, alongside you.

Sincerely,

Jeffrey Kolitch, Portfolio Manager

Investors should consider the investment objectives, risks, and charges and expenses of the investment carefully before investing. The prospectus and summary prospectus contain this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99-BARON or visiting baronfunds.com. Please read them carefully before investing.

Risks: In addition to general market conditions, the value of the Fund will be affected by the strength of the real estate markets as well as by interest rate fluctuations, credit risk, environmental issues and economic conditions. The Fund invests in debt securities which are affected by changes in prevailing interest rates and the perceived credit quality of the issuer. The Fund invests in companies of all sizes, including small and medium sized companies whose securities may be thinly traded and more difficult to sell during market downturns.

The Fund may not achieve its objectives. Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk.

Discussions of the companies herein are not intended as advice to any person regarding the advisability of investing in any particular security. The views expressed in this report reflect those of the respective portfolio managers only through the end of the period stated in this report. The portfolio manager’s views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time based on market and other conditions and Baron has no obligation to update them.

This report does not constitute an offer to sell or a solicitation of any offer to buy securities of Baron Real Estate Income Fund by anyone in any jurisdiction where it would be unlawful under the laws of that jurisdiction to make such an offer or solicitation.

The portfolio manager defines “Best-in-class” as well-managed, competitively advantaged, faster-growing companies with higher margins and returns on invested capital and lower leverage that are leaders in their respective markets. Note that this statement represents the manager’s opinion and is not based on a third-party ranking.

BAMCO, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Baron Capital, Inc. is a broker-dealer registered with the SEC and a member of the Financial Industry Regulatory Authority, Inc. (FINRA).

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.